MAKE A DONATION TO SUPPORT KINGDOM IMPACT MINISTRY

Your generous gift, whether a single donation or monthly partnership, is crucial. It enables us to broadcast video messages, podcasts, live streams, special events, and online training for free, reaching people globally. With every contribution, you help us win souls and make disciples of all nations, transforming lives through the Gospel and God's miraculous power. Together, we ignite change and extend hope and healing worldwide. This mission couldn't be done without your help. Join us—let's transform the world through the power of the Holy Spirit.

You can give through our fast and secure online giving option: Donate by Credit/debit card, Paypal, Bank Account Transfer, Apple Pay, Google Pay, Mercado Pago, or Venmo using the donation form below.

Other Giving Options

1 (855) 41VOICE (418-6423)

Together, transforming lives through the gospel and the miracle-working power of God!

STORIES OF LIVES IMPACTED BY THE GOSPEL OF REDEMPTION AND THE POWER OF GOD!

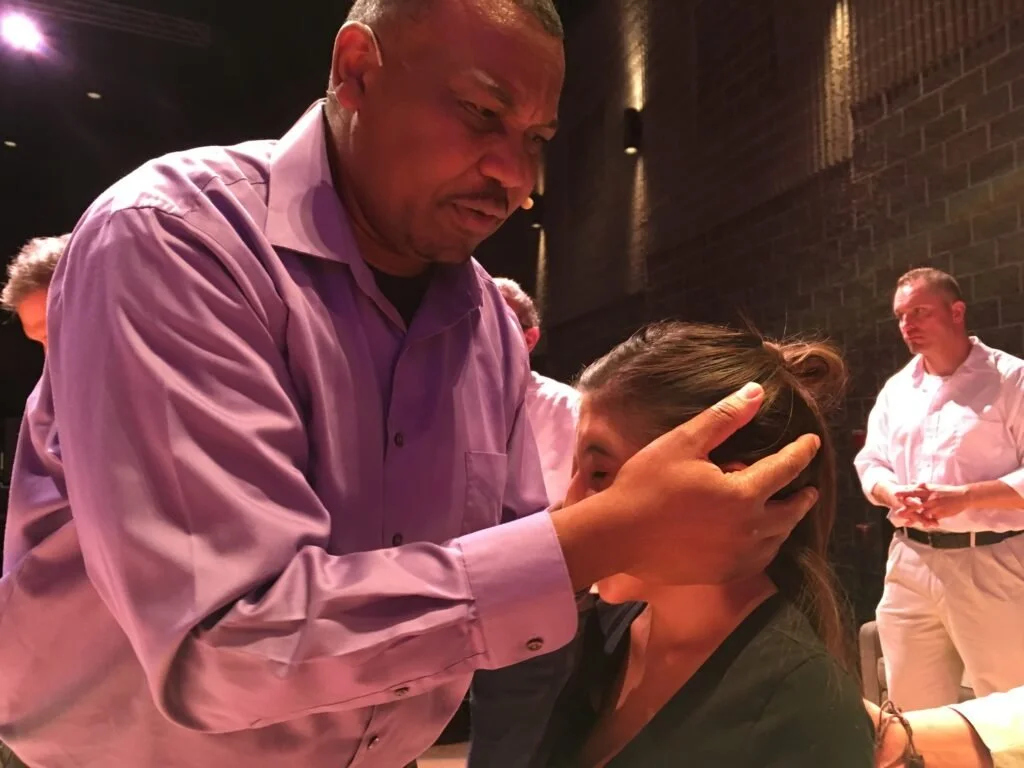

“I was miraculously healed from lower back pain after Andrew prayed for me. I suffered for 12 years due to a crushed and twisted herniated disc.”

“Andrew prayed the miracle healing power of God on the audience. The next morning, I found that my foot had grown new tendon, cartilage, and muscles that I didn’t have before…”

“The power of God was like lightning … when Dr. Andrew Nkoyoyo prayed for me. I was instantly healed from damaged vocal cords, delivered from 10 years of hip pain, and 43 years of excruciating migraine headaches caused by a car accident. Wow!!”

“Andrew’s training has elevated my walk with the Lord. I’m discerning and hearing God’s voice more strongly than ever before.”

More Ways To Give and Make an Impact

GIFTS OF STOCKS, BONDS, AND MUTUAL FUNDS

Donating appreciated securities, including stocks, mutual funds, or bonds, is an easy and tax-effective way for you to make a gift to Kingdom Impact Ministry.

Benefits of Gifting Stocks, Bonds, and Mutual Funds:

Avoid paying capital gains tax on the sale of appreciated stock.

Receive a charitable income tax deduction.

Further our mission today.

How to Make a Gift of Stocks, Bonds, and Mutual Funds:

By Electronic Transfer: Please contact us for instructions on how you can transfer stock or bonds from your brokerage or investment account to Kingdom Impact Ministry.

By Certified Mail: If you hold securities in certificate form, you will need to mail two envelopes separately to complete your gift. In the first envelope, place the unsigned stock certificate(s). In the other envelope, include a signed stock power for each certificate. You may obtain this power from your broker or bank. Please remember to use certified mail.

CONTRIBUTIONS OF AUTOS AND ITEMS

Our ministry is in need of various items to fulfill our mission, and we would love to accept a donation of these.

Media & Video Production Equipment:

We would love to accept a donation of items in good used condition or better. We maintain a current list of needed items.

Large Items Such as Vehicles:

Mobility is a key component of our ability to spread the message. We are in need of a vehicle to pick up supplies, get to the filming studio, and operate efficiently. Large items such as vehicles can generally be deducted at their fair market value on the date of the contribution. If you have a vehicle in good running condition that you would like a tax deduction for, we would love to hear from you!

Inventory, Office Supplies, and Equipment:

Have a few extra items in your business that you no longer use? You can contribute inventory or items in your office to help us out!

CHARITABLE BEQUESTS & BENEFICIARY DESIGNATIONS

A charitable bequest or beneficiary designation is one of the easiest and most flexible ways that you can leave a gift to Kingdom Impact Ministry that will make a lasting impact. With the help of an attorney, you can include language in your will or trust specifying a gift to be made to family, friends, or Kingdom Impact Ministry as part of your estate plan. Alternatively, you can make a bequest using a beneficiary designation form for a retirement, investment, or bank account, or your life insurance policy by designating us as the recipient.

Benefits of a Bequest or Beneficiary Designation:

Support the causes that you care about.

Receive an estate tax charitable deduction.

Reduce the burden of taxes on your family.

Leave a lasting legacy to charity.

Ways to Make a Bequest:

Percentage Bequest - Give a percentage of your estate.

Specific Bequest - Give a specific dollar amount or asset.

Residual Bequest - Give the remainder of your estate after other bequests have been made.

Steps to Make a Bequest or Beneficiary Designation:

Include a bequest to Kingdom Impact Ministry in your will or revocable trust.

Contact your broker, banker, or insurance agent and request a new beneficiary designation form. Complete the form, designating Kingdom Impact Ministry as a full, partial, or contingent beneficiary of your retirement account (IRA, 401(k), 403(b), or pension), sign it, and mail it back.

Important Considerations for Your Future:

If you are interested in making a gift but are also concerned about your future needs, remember that bequest and beneficiary designation gifts are among the most flexible of all charitable gifts. Even after completing the beneficiary designation form, you can take distributions or withdrawals from your accounts and continue to use them freely. You can also change your mind at any time for any reason, including if you have a loved one who needs financial help.

If you have any questions, please contact us. We would be happy to assist you. If you have included a bequest or beneficiary designation to Kingdom Impact Ministry in your estate plan, please let us know. We would like to recognize you and your family for your generosity.

GIFTS OF REAL ESTATE

Donating appreciated real estate, such as a home, vacation property, undeveloped land, farmland, ranch, or commercial property can make a great gift to Kingdom Impact Ministry.

Benefits of Gifts of Real Estate:

Avoid paying capital gains tax on the sale of the real estate.

Receive a charitable income tax deduction based on the value of the gift.

Leave a lasting legacy to Kingdom Impact Ministry.

How to Make a Gift of Real Estate:

Your real property may be given to Kingdom Impact Ministry by signing a deed transferring ownership. You may deed part or all of your real property to Kingdom Impact Ministry. Your gift will generally be based on the property's fair market value, established by an independent appraisal.

BARGAIN SALE:

We are looking for property for Kingdom Impact Ministry’s future headquarters. If you have property to sell and seek a strategy to reduce your income taxes, a bargain sale might be right for you.

Benefits of a Bargain Sale:

Avoid capital gains tax on your charitable gift.

Receive a tax deduction that will reduce your tax bill this year.

Take the cash received from the sale and reinvest it to create future income, save for retirement, buy new property, or achieve other financial goals.

Help Kingdom Impact Ministry further our important charitable work.

How a Bargain Sale Works:

You sell Kingdom Impact Ministry your property for a price less than fair market value.

You receive cash from the sale.

You can take a charitable deduction for the value of your gift, which is the difference between the fair market value of the property and the sale price.

Even if you have a mortgage on your property, a bargain sale may still be an option. Consult with your tax advisor before completing a gift of a bargain sale.

LIFE ESTATE RESERVED:

If you want to leave your home or farm to Kingdom Impact Ministry at your death but would like to receive a current charitable income tax deduction, a life estate reserved might be the solution you need.

Benefits of a Life Estate Reserved:

Receive a federal income tax deduction for the value of the remainder interest in your home or farm.

Preserve your lifetime use and control of your home or farm.

Create a life estate based on more than one life, preserving the use of the property for you and a loved one.

How a Life Estate Works:

You deed your home or farm to Kingdom Impact Ministry. The deed will include a provision that gives you the right to use your home or farm for the rest of your life and that of any other life estate party named in the deed.

You and Kingdom Impact Ministry sign a maintenance, insurance, and taxes (MIT) agreement, ensuring the property is kept in good condition, insured, and that property taxes are paid.

Upon the death of the life estate owners, the property belongs to Kingdom Impact Ministry, to be used or sold to further our charitable work.

If you have any questions or need assistance, please contact us. We are here to help you make a lasting impact through your generosity.